Software == Services

eventually™

ChatGPT is a bad product.

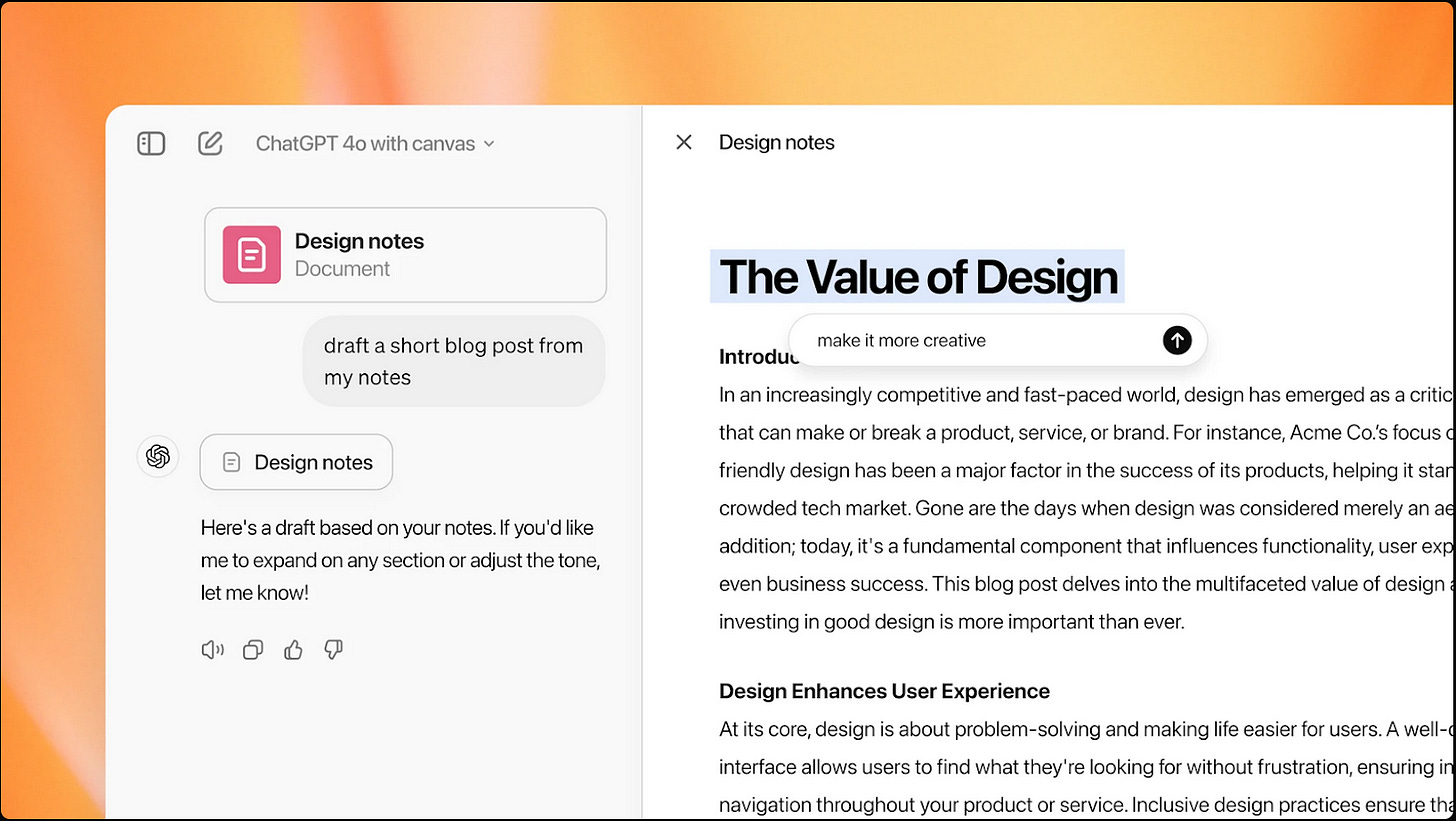

A good product wouldn’t have so many use-case specific wrappers, sucking away revenue which should be going directly to the machine god. They’re working towards this though: OpenAI hopes that Canvas will become a better interface than chat to interact with an LLM, adapting to your use case, pulling in highlighted context, so on. In the same vein, Desktop is a way to bring AI directly to your workflow and data. They’re both general interfaces, and in the limit, the hope is for them to soak all wrapper use cases (and revenue). No more crappy chat with PDF wrappers, just a single super app that does everything.

Salesforce is, uh, wait, what is Salesforce?

Salesforce is whatever sales teams want it to be. Sales teams hire consultants to implement changes around the customer data in Salesforce to best fit their needs. Maybe that's custom fields for tracking industry-specific metrics or setting up complex approval chains. These consultants answer to sales and only sales - nobody has to loop in engineers, who would rather be tweaking frontend buttons or tweaking their RAG implementation anyways.

Software -> Services

These two examples point to a simple core idea: there’s lots of latent demand for software that’s customized to a specific person’s or team’s workflow. ChatGPT delivers the customizations with AI, while Salesforce delivers the customizations with consultants.

A new thesis: services and software businesses will converge to the same model, with core software services that are customized and delivered by higher touch representatives.

In the ChatGPT example, the consumer prompts and the interface shifts around them - the consumer is also the implementor of the final interface. Lots of cool prosumer stuff to be done, I’m sure it will be very cool and fun, but I’m skeptical of the market size and how much value can be properly extracted here. Most people do not actually care about customization, which is why Ghostty’s zero configuration policy is so good.

While consumer AI might struggle with customization fatigue, B2B is going to be a fascinating battleground. Software companies with well-tested and strong core infrastructure could build custom UI’s and workflows around that core system of record to support any use case. Most enterprise software companies look kind of similar today: sales talks to customers and promises features that don’t exist and then beg engineers to build them. AI codegen changes the game by dropping the cost of customization and opening this strategy to SMB sales too. I bought software at Square when it was worth $150B - vendors would customize anything for us then, but can now offer that same white glove service to any customer, whether they're spending $500 or $500k per month.

This is a generalization of the Palantir motion. There’s core infra with lots of automation and battletested abstractions, and FDE’s come and implement data integrations plus other workflows or other client-specific tools.

That’s an incredibly strong position of leverage. How do most newcomers attempt to knock off incumbents? By building point features to win customers and then land and expand. But in this world, building the point feature is significantly faster and customers have high contact with their rep already, so drawing customers away will be extremely hard. Take Salesforce - a startup might build a better pipeline visualization tool as a wedge, but AI-enabled Salesforce consultants can just spin up something similar while maintaining all the existing integrations and relationships. Customers win, it’s a much better experience, why would they churn from this software that gets them exactly and is tightly integrated with what makes them money?

Amusingly, this makes the ‘what would you say you do here’ guy’s job incredibly valuable. For the model to work, you need to get sales, product, engineering, and customers on the same page about what change to make. This is, well, difficult. Sales guys will promise anything to get their bonus, no matter how complex the engineering or how unrealistic the economics. Customers will ask for everything without actually describing what would properly solve their pain points (see the XY problem). When I was buying enterprise software, I had to climb the entire org chart - from sales to application engineer to product manager to infra engineer - just to understand what I was actually buying. We will need to solve human communication (difficulty: impossible) before we fully automate B2B software, so that’s good news. (previous related blog post).

Instead of fully automating employees away, I think we will see more ‘technical PM who can sell’ types. Some engineers will learn to be customer facing, some PM’s and sales folks will learn engineering, and so on. This doesn’t necessarily mean mass layoffs, just a different valuable skill set, likely with a much larger human and sales element.

Services -> Software

Now, what’s interesting is that the software and services businesses in an industry will end up looking very similar to each other. We’ve talked about how software businesses will add stronger service elements to win contracts (before, as well). Traditional ervices businesses will need to improve their margins and cost of delivery to compete. How? Software and AI!

Let’s take accounting as an example. Software teams are trying to automate bookkeeping by building software that does most of the backend (think ingestion, attribution, reconciliation), but still having a human available for support and custom scenarios. (My friend is building this for ecomm businesses for example!). In this model, the software is there, but a lot of the value (and customizations) are delivered by an accountant still. The bet is that more and more of what accountants have to manually do today can be categorized, described, and automated, so the software company can accrue better margins despite having services.

Well, could accounting firms do this too? The firms already have strong relationships with existing customers that might be difficult to win otherwise, as well as lots of institutional knowledge and historical workflow data. You could imagine an internal team similarly building the software out internally to automate these flows, with the data advantage. Alternatively, they might buy it from one of the dozen accounting AI startups out there and end up in the same place.

A challenge might be professional development: automating work and reducing the number of junior and mid level spots will stunt career growth. However, there’s already huge labor shortages, as the number of new CPA’s has dropped nearly 50% since 2016 and 75% are nearing retirement age. Many other industries face similar labor headwinds as tech and finance have inflicted a variant of Baumol’s disease. It is possible that, just as with software, the services path ends up looking much more customer facing and sales focused. You don’t make partner just by sticking around, you make partner by winning business.

When you start looking at services firms through this lens, a lot of them end up blurring together. Like, how much of the legal process in personal injury cases could be automated? Discovery, document review, case law research, settlement calculations - probably a lot of it. Real estate transactions are already halfway there, with automated title searches and standardized contracts, but you still need someone to walk first-time homebuyers through the biggest purchase of their lives. Even management consulting could automate their market research and data crunching, though they'd never admit it. The pattern's pretty clear: automate the backend, keep the suits for the meetings. After all, someone still needs to shake hands and explain the documents to the client.

Will software or services win? Does it matter? Por que no los dos?